After 28 years of legal limbo, the estate of O.J. Simpson has finally agreed to pay nearly $58 million to the families of Nicole Brown Simpson and Ronald Lyle Goldman—a settlement that closes one of the most haunting chapters in American legal history. The agreement, announced on November 17, 2025, by Malcolm Leverne, the executive managing Simpson’s estate, brings a long-sought measure of accountability to the families who’ve spent decades fighting for justice after Simpson’s 1995 criminal acquittal. The payout includes the original $33 million civil judgment from February 4, 1997, plus 28 years of accrued interest under California law—a sum that grew steadily at 10% annually, as mandated by the California Code of Civil Procedure Section 685.010. But here’s the thing: the money doesn’t just go to the families. First, the Internal Revenue Service must be paid.

The Long Road to Payment

It’s hard to overstate how relentless Fred Goldman was. The father of Ronald Lyle Goldman, who was 25 when he was stabbed to death outside 875 South Bundy Drive in Brentwood on June 12, 1994, never let the case fade. While Simpson lived lavishly—buying luxury cars, collecting memorabilia, and even appearing on TV—Goldman kept the pressure on. He gave interviews. He filed liens. He showed up at events. He told reporters, “I don’t want them to get anything.” And for nearly three decades, Simpson’s estate dodged, delayed, and denied.

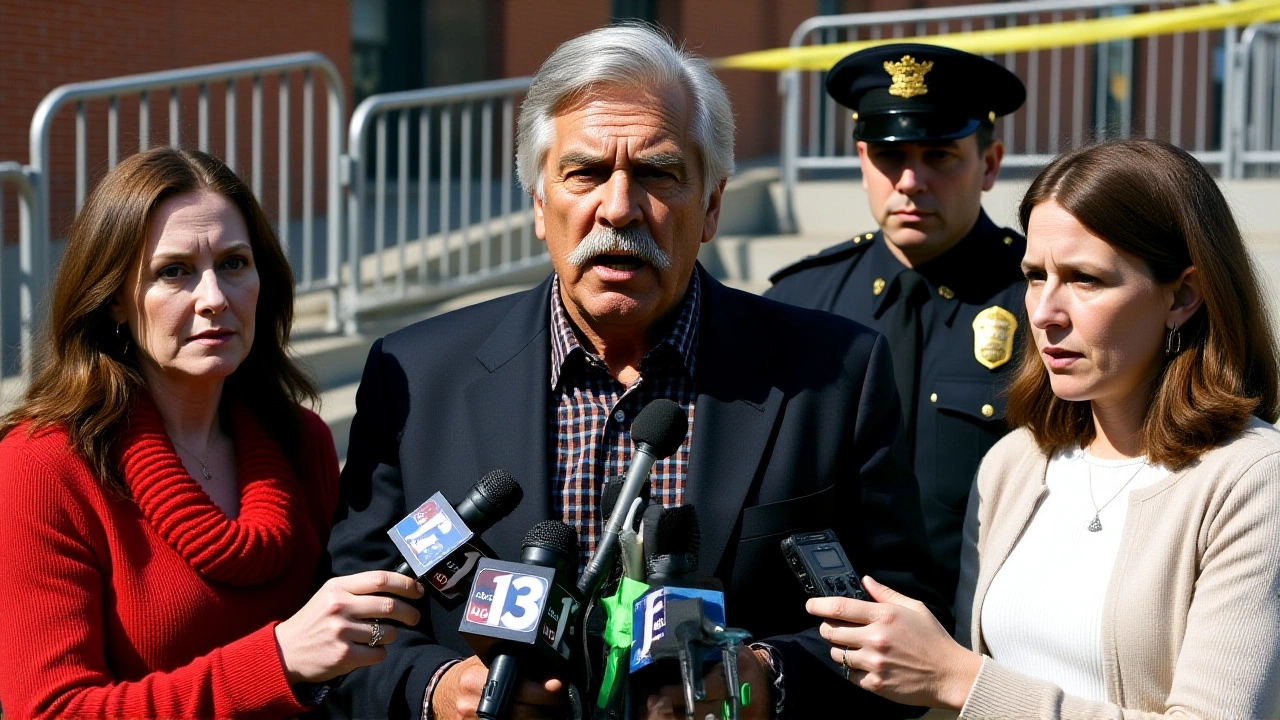

That changed after Simpson’s death, which occurred sometime before November 2025. With no more hiding, the burden fell to Malcolm Leverne, the estate’s court-appointed executor. Leverne didn’t just sign off—he negotiated. He knew the numbers: $33 million in damages, plus $25 million in interest alone since 2000. By 2025, the total ballooned to $58 million. But Leverne was blunt: “The IRS has to be paid first.” That means the estate must settle federal tax liens before any dollar reaches the families. He estimated the estate needed to be worth “well north of $16 million” just to cover the IRS and still leave enough for the judgment. Whether that’s true? Still unclear.

How the Interest Piled Up

California law doesn’t play nice with unpaid judgments. Section 685.010 mandates 10% annual interest on civil judgments—compound, not simple. That’s not a loophole. That’s the law. So when Judge Hiroshi Fujisaki ordered Simpson to pay $8.5 million in compensatory damages and $25 million in punitive damages on February 4, 1997, he wasn’t just punishing Simpson. He was creating a financial time bomb.

Let’s do the math. $33 million at 10% annual interest compounds to roughly $58 million after 28 years and nine months. That’s not inflation. That’s legal compounding. And it’s why this isn’t just about justice—it’s about financial consequence. The Goldman family’s attorney, David Cook, who helped win the original case, confirmed the settlement terms are being formalized under probate court procedures. But the court location? Still undisclosed. The exact split between the Goldman and Brown families? Also not public. What we know: both families will share the proceeds.

Why This Matters Now

This isn’t just about closing a book. It’s about sending a message: even the most powerful can’t outrun accountability forever. Simpson, once a national icon, became a symbol of privilege escaping consequences. His acquittal in criminal court in 1995—despite overwhelming forensic evidence—left the victims’ families feeling abandoned by the system. The civil verdict was their only path to justice. And for 28 years, that path was blocked by silence, obfuscation, and legal maneuvering.

Now, with Simpson gone, the estate is forced to face what it long avoided. The IRS’s first claim isn’t just bureaucratic—it’s symbolic. Tax authorities, not the victims, get paid first? That’s the system. But the fact that any payment is happening at all is a victory for persistence. Fred Goldman, now 80, didn’t win because of a new law or a public outcry. He won because he showed up. Every year. Every interview. Every court filing. He never let the world forget.

What Comes Next

The settlement isn’t final until probate court approves it. That process could take months. The IRS must also agree to the payment structure—likely through a negotiated lien release. Only then can funds flow to the families. There’s no deadline. No timeline. But legal experts say this is the most credible resolution since 1997. “This isn’t a gift,” said one probate attorney in Los Angeles. “It’s the last legal obligation Simpson ever had. And now, finally, it’s being honored.”

For the families, the money is secondary. What matters is that the world saw it: justice, delayed, wasn’t denied. It was simply waiting for the right moment.

Frequently Asked Questions

How did the $58 million total come about?

The $58 million includes the original $33 million civil judgment from 1997—$8.5 million in compensatory damages and $25 million in punitive damages—plus 28 years of 10% annual interest as required by California law. Compounded over nearly three decades, that interest alone added over $25 million to the original award. The exact calculation follows the state’s civil judgment interest statute, which does not cap accrual.

Why does the IRS get paid first?

Federal tax liens take priority over civil judgments under U.S. bankruptcy and probate law. If O.J. Simpson’s estate owed back taxes—likely from income earned after the trial—the IRS has a legal claim that must be settled before any other creditor, including the Goldman and Brown families. Malcolm Leverne confirmed the estate must be worth more than $16 million just to cover IRS obligations before distribution.

Who is Malcolm Leverne, and why is he in charge?

Malcolm Leverne is the court-appointed executor of O.J. Simpson’s estate, responsible for managing assets and settling debts after Simpson’s death. He was named by a probate court in the jurisdiction where Simpson’s will is being processed—likely California. His role is to ensure all legal obligations, including taxes and civil judgments, are satisfied before distributing any remaining assets to beneficiaries.

Will the Goldman family actually receive the full $58 million?

No. The $58 million is the total obligation, but after IRS claims, legal fees, and probate costs, the net amount distributed to the Goldman and Brown families will be less. The exact split between the two families hasn’t been disclosed, but legal sources suggest it will follow the original judgment’s allocation—roughly two-thirds to the Goldman family and one-third to the Brown family, based on the jury’s original determination.

What assets does O.J. Simpson’s estate have?

Public records suggest Simpson’s estate includes royalties from his memoir, rights to media interviews, personal memorabilia, and possibly real estate. But much of his wealth was liquidated or hidden during his lifetime. The estate’s true value remains confidential, though Leverne’s statement that it must be “well north of $16 million” implies at least some significant assets remain—likely from ongoing licensing deals tied to his NFL and broadcasting legacy.

Why didn’t the Goldman family get paid earlier?

Simpson spent decades shielding his assets—transferring property, hiding cash, and exploiting legal loopholes. He was never jailed for non-payment because civil judgments don’t carry jail time. Fred Goldman filed liens and pursued garnishments, but Simpson’s legal team consistently delayed, appealed, or claimed insolvency. It took Simpson’s death to remove the final barrier to enforcement.

Author

Maverick Leclair

Hi, I'm Maverick Leclair, a sports enthusiast with a passion for motorsports. I've spent years honing my expertise in various sporting disciplines, but my true love lies in the adrenaline-pumping world of racing. As a writer, I enjoy sharing my insights and experiences with fellow fans of high-speed pursuits. From Formula 1 to MotoGP, I've got you covered with the latest news, analysis, and in-depth features. Join me as we explore the fascinating world of motorsports together.